Notes on Marimo

Marimo is a reactive notebook system in Python. Here are some thoughts on it:

- Reactivity is implemented by re-writing Python expressions in the cells by means of (it appears) static analysis. The on-disk format is the rewritten expression.

- The rewrite makes all inputs and outputs explicit parameters/return values. This rewrite turns global variables into function parameters/returns

- This work well for the (simple) cases tested so far. Not sure it is a that big advantage for an experienced Python developer but perhaps it is for newcomers.

- A reactive notebook system “Pluto” has been available for the Julia ecosystem for some time.

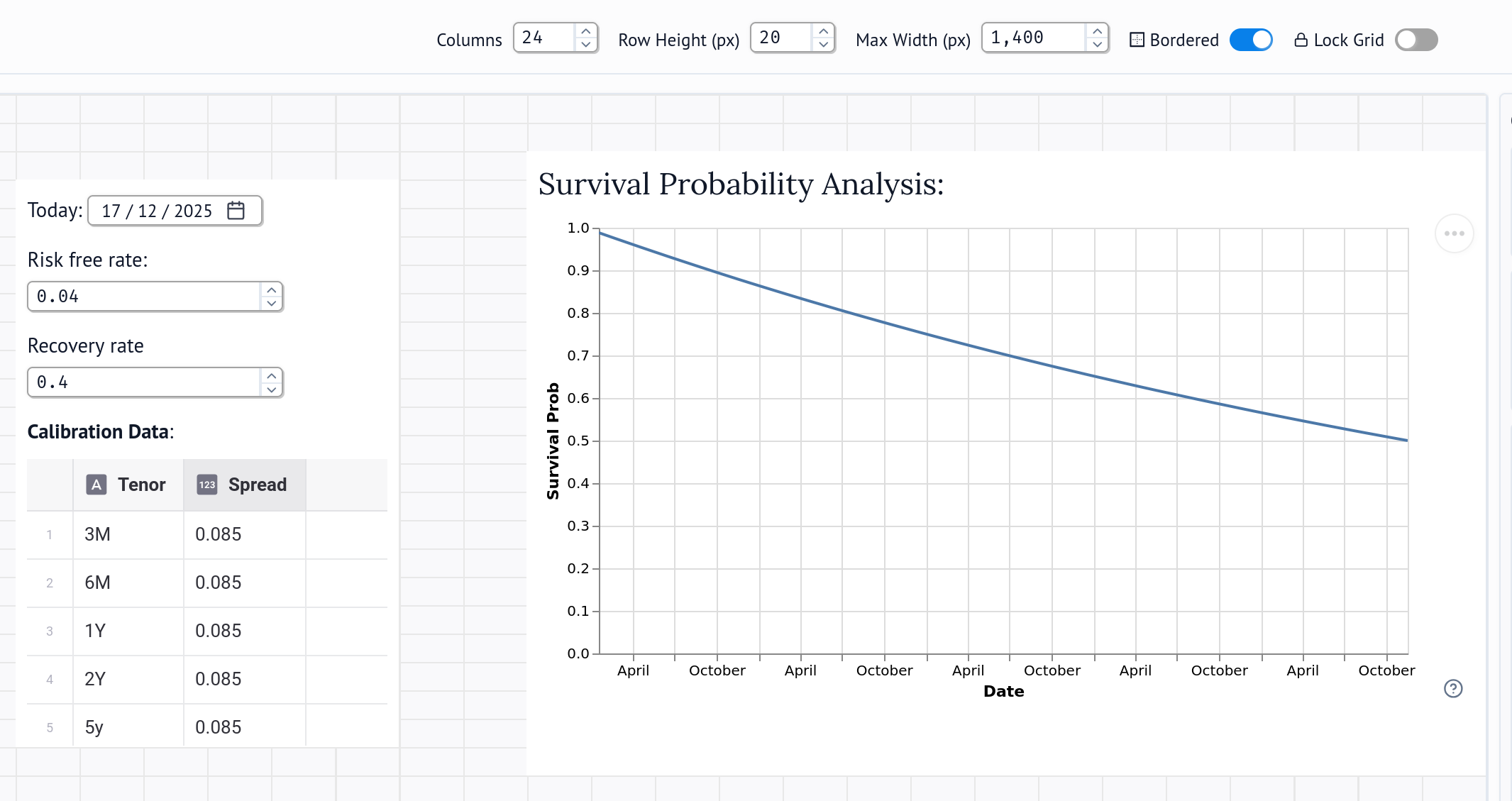

- There is a nice two-dimensional notebook layout in Marimo

- The on-disk format is extremely easy to read, and automatic watch functions means editing outside of Marimo works very well

- The usual IDE assists seem to work well in the notebook

- And in the time it has taken me to put together these notes and some experiments I seen they’ve been bought by Corewave: https://marimo.io/blog/joining-coreweave !

And here is a very quick illustration of the two-dimensional layout:

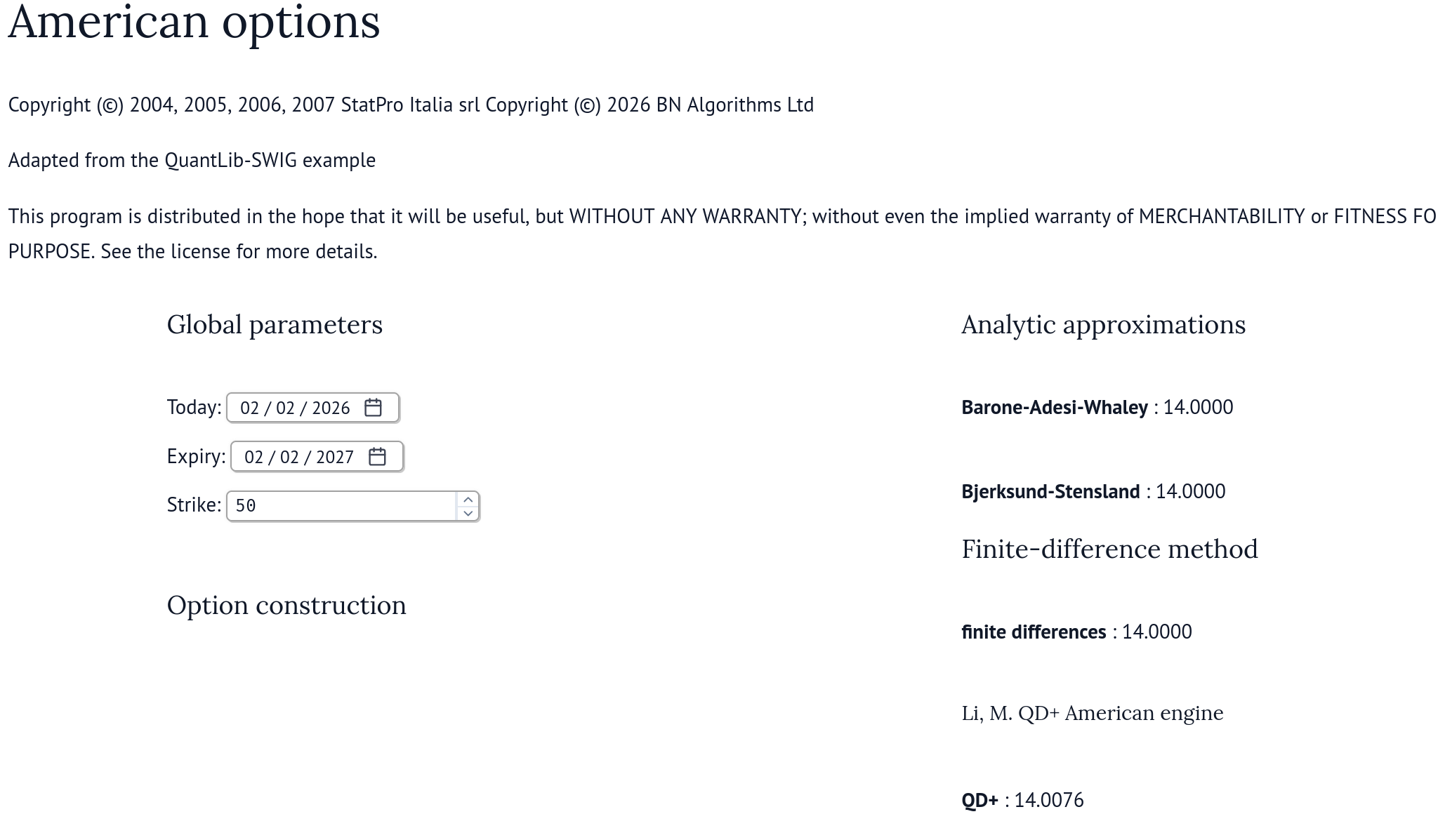

Here is a quick conversion of QuantLib American Option example:

American options

Copyright (©) 2004, 2005, 2006, 2007 StatPro Italia srl Copyright (©) 2026 BN Algorithms Ltd

Adapted from the QuantLib-SWIG example

This program is distributed in the hope that it will be useful, but WITHOUT ANY WARRANTY; without even the implied warranty of MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the license for more details.

import QuantLib as ql

import pandas as pd

import qlutils

Global parameters

todaysDate = mo.ui.date()

expiryDate = mo.ui.date()

K = mo.ui.number(1, 100, step=0.1)

mo.vstack([ mo.md(f"Today: {todaysDate}"),

mo.md(f"Expiry: {expiryDate}"),

mo.md(f"Strike: {K}"),

])

Option construction

ql.Settings.instance().evaluationDate = qlutils.qlDate(todaysDate.value)

exercise = ql.AmericanExercise(qlutils.qlDate(todaysDate.value),

qlutils.qlDate(expiryDate.value))

payoff = ql.PlainVanillaPayoff(ql.Option.Put, K.value)

option = ql.VanillaOption(payoff, exercise)

Market data

underlying = ql.SimpleQuote(36.0)

dividendYield = ql.FlatForward(qlutils.qlDate(todaysDate.value), 0.00, ql.Actual365Fixed())

volatility = ql.BlackConstantVol(qlutils.qlDate(todaysDate.value), ql.TARGET(), 0.20, ql.Actual365Fixed())

riskFreeRate = ql.FlatForward(qlutils.qlDate(todaysDate.value), 0.06, ql.Actual365Fixed())

process = ql.BlackScholesMertonProcess(

ql.QuoteHandle(underlying),

ql.YieldTermStructureHandle(dividendYield),

ql.YieldTermStructureHandle(riskFreeRate),

ql.BlackVolTermStructureHandle(volatility),

)

Pricing

We’ll collect tuples of method name, option value, and estimated error from the analytic formula.

Analytic approximations

option.setPricingEngine(ql.BaroneAdesiWhaleyApproximationEngine(process))

BaroneAdesiNPV = option.NPV()

mo.md(f'**Barone-Adesi-Whaley** : {BaroneAdesiNPV:.4f}')

option.setPricingEngine(ql.BjerksundStenslandApproximationEngine(process))

mo.md(f'**Bjerksund-Stensland** : {option.NPV():.4f}')

Finite-difference method

timeSteps = 801

gridPoints = 800

option.setPricingEngine(ql.FdBlackScholesVanillaEngine(process, timeSteps, gridPoints))

mo.md(f'**finite differences** : {option.NPV():.4f}')

Li, M. QD+ American engine

option.setPricingEngine(ql.QdPlusAmericanEngine(process))

mo.md(f'**QD+** : {option.NPV():.4f}')

Leif Andersen, Mark Lake and Dimitri Offengenden high performance American engine

option.setPricingEngine(

ql.QdFpAmericanEngine(process, ql.QdFpAmericanEngine.accurateScheme())

)

mo.md(f'**QD+ fixed point** : {option.NPV():.4f}')

Binomial method

timeSteps_1 = 801

r =[]

for tree in ['JR', 'CRR', 'EQP', 'Trigeorgis', 'Tian', 'LR', 'Joshi4']:

option.setPricingEngine(ql.BinomialVanillaEngine(process, tree, timeSteps_1))

r.append( mo.md(f'**Binomial ({tree}) differences** : {option.NPV():.4f}'))

mo.vstack(r)

import marimo as mo

Produces following app: